Episode 358 – February 09, 2023

Listen On: Apple Podcasts | Spotify | Google Podcasts | YouTube

This is a debate you will not hear anywhere else! Two of Vancouver real estate’s most respected thought leaders are in the same room… and they’re joined by Prof. Tom Davidoff and Prof. Andrey Pavlov. We kid, we kid. But seriously, it’s not often that we get to sit down with this level of dialogue while two leading professors debate the merits and shortcomings of our real estate market.

We can all agree on one thing: these two don’t agree on much! How can we fix Vancouver real estate? Is the bottom in? And where does the market go from here? This episode has more jabs than a Sonny Listen fight. Ding, ding, ding!

Guest Information

Thomas Davidoff

Thomas Davidoff is an economist, as well as a professor at the Sauder School of Business at UBC teaching economics and real estate.

- BA (Harvard), MPA/URP (Princeton), PhD (MIT)

- Stanley Hamilton Professorship in Real Estate Finance

- Director, UBC Centre for Urban Economics and Real Estate

- Associate Professor, Strategy and Business Economics Division

Andrey Pavlov

Andrey D. Pavlov specializes in risk management for real estate, financial derivatives and digital currency investments at the Beedie School of Business, Simon Fraser University, Vancouver, BC, where he is professor of finance. He has also worked on the modelling of aggressive lending practices, risk management for publicly traded real estate companies, and mortgage and equity securitization.

He earned his Ph.D. from the Anderson School at the University of California, Los Angeles (1999) and was a visiting Associate Professor at the Wharton School, University of Pennsylvania during the 2006 – 2008 period. Since then he has continuously taught real estate finance for the Wharton Executive Education program. He is a fellow of the Ziman Real Estate Center at UCLA, a winner of the Homer Hoyt Advanced Studies Institute Best Dissertation Award (2000), and a post-doctoral honoree of the Homer Hoyt Advanced Studies Institute (2005).

Professor Pavlov has a wide range of academic and industry-oriented publications. He has consulted for the U.S. Financial Industry Regulatory Authority, the U.S. Department of Housing and Urban Development, the Government of Canada, the Government of British Columbia, the Canadian Mortgage and Housing Corporation, and private sector insurers, mortgage lenders and hedge funds.

Episode Summary

UBC’s Tom Davidoff and SFU’s Andrey Pavlov go head to head to decide if taxation is causing Vancouver’s real estate crisis. Are property taxes too high or too low? Is the government helping or hurting supply? And who is the next bad guy to blame for Vancouver’s housing problems?

Who are Tom Davidoff and Andrey Pavlov?

Tom: I’m an economist and teach at the Sauder School of Business at UBC.

Andrey: I’m a finance professor, mostly specializing in real estate, at the Beedie School of Business at SFU.

Does Vancouver have a taxation problem?

Andrey: Yes, but not a real estate taxation problem. Income taxes, sales taxes, gas taxes, airport fees, property taxes – those are all problems.

In my view, Vancouver property taxes are very high. Single family homeowners pay the highest property taxes in Canada. The rates are low but when you multiply it by the house price, it’s very high. I don’t feel that’s represented in our city services; we don’t get what we pay for.

Tom: I agree with Andrey that we do have high taxes on a lot of activities in a regulatory system that isn’t functioning as well as it could. But Vancouver is a fantastic city and many of the services here are great. Streets are generally safe, trash is collected regularly, schools are good, etc. What is that worth?

If you’re a single-family homeowner with a $2 million home, you’re maybe paying $6,000 per year for that. That doesn’t strike me as a lot of money. What does strike me as a lot of money is what you have to pay in income taxes. If you want to put 20% down on that $2 million house, you need $500,000 in annual income, which is over $100,000 in income taxes.

So it’s $100,000 in income tax VS $6,000 in property taxes. Does Canada want more people working and selling or buying property? In my opinion, they should load up on the property taxes and go easy on the income taxes. But we’re so out of whack on that.

I did a study with Paul Boniface Akaabre and Craig Jones that showed that half the people who bought super expensive properties in Vancouver actually pay $0 in income taxes. The median owner pays about $16,000 per year in income taxes. So something is wrong.

Keep your finger on the pulse of Vancouver’s real estate market with our Live Wire email newsletter.

Andrey, what is your response to Tom’s research on Vancouver property taxes?

Andrey: I think we’ll discover that Tom and I are much closer on a lot of things than it appears. But let’s get this one out of the way.

The issue with the study Tom referenced is it looks at one year of income tax. Buying a house is a lifetime of savings and earnings, or longer. That would be like looking at how far we’ve walked in the last minute and comparing it to how far we’ve walked all morning. It’s not representative.

You might find that someone who has bought a multi-million dollar property is going to work less because they’ve made it, and that’s why their one-year income tax is low. Or maybe they retired.

You can’t look at one year of income and compare it to a lifetime of earnings and savings. So the study doesn’t show that homeowners don’t pay income taxes; those taxes may just have been paid at a different time or at another place.

Tom: I agree with a lot of what Andrey is saying. Wealth is a stock and income is a flow; they don’t always match. People do take time off or sell businesses. Maybe 2018 was a crazy anomaly where everyone took time off. But I don’t think that’s what happened.

Even if it is a lifetime of savings, or money earned overseas, or parents saving up for their children, we have to ask: Is that what we want to reward in Vancouver?

Do we want to say, “You crossed the finish line, welcome to your palatial home, here’s the low income tax you deserve?” I don’t think so. We want to design a tax policy and government system for people who work for a living and need a place to live.

We’ve talked about Vancouver being an anomaly in terms of how high or how low taxes are. In North America, are there other areas that have skewed income VS property taxes?

Tom: Most of the US. New Hampshire would be a classic example – they have a lot of high earners, almost no income tax, and high property tax. It’s a similar story in New York.

But the US system is different because each municipality pays for their own school system. If you can afford it, that’s great. But if not, you’ll be stuck in a low income trap.

What are the complications if people don’t pay high income tax and yet live in some of the most expensive places in Canada?

Tom: It comes down to money. We suggested that everyone of working age has to pay 1% of their property value as income tax. If you already do pay that much or more, then no change.

But if you’re 25 years old and your dad just bought you a $3 million house, you have to pay $30,000 as income tax or some kind of tax. If that 25 year old doesn’t work for a living, they may need to sell the house and it gets redeveloped or bought by someone who does work.

It’s not about fairness and who gets to live where. It’s $2 billion you’d collect just from the top 10% of properties. That’s a lot of money we could use to provide rental housing, help the homeless, etc.

Andrey: I do agree that income taxes are unbelievably high. So let’s drop them. Unfortunately as a country, we have actually gone the opposite way.

Tom and I actually had this same conversation when we were developing the speculation and vacancy tax proposal. We suggested if you’re making any money in Canada and paying taxes, it should offset your speculation tax and vacancy tax payment. But if you come from another country and only benefit from owning in Canada while not paying anything, there’s nothing wrong with the government collecting taxes from you.

That was the proposal. But what we got is completely different!

We have a tax that is primarily paid by local British Columbians who are working and paying taxes in BC. The income tax offset never came. It became another slush fund for our politicians to buy buildings out of thin air instead of creating more supply. We created a monster that collects more taxes from people to the detriment of everyone, including renters.

We saw a similar thing with the carbon tax; it was supposed to be revenue-neutral. Tom and I both bike and so we should be better off under the carbon tax regime. But we’re not, because once you hit a certain income threshold, you get no carbon tax rebate.

Our government has a history of introducing measures that have economic bases, as long as they’re revenue-neutral. But they are never revenue-neutral. They’re always another way to tax people.

So my concern with Tom’s proposal is that we’re going to increase property taxes but we’re not going to decrease income taxes or regulation in a meaningful way.

Tom: I want to point out one more thing. A lot of high net worth people in BC do work but they have small businesses with low corporate tax. I don’t think that’s what is going on in the data, but it’s another avenue to reduce taxes.

How are taxes impacting the doctor shortage in Canada?

Andrey: I actually think the corporate tax issue that Tom just brought up, which has actually been removed, is why we have so few doctors, dentists, engineers, etc. these days. We removed the incentive, which was a negotiated benefit.

Doctors said that they would give up higher fees in order to run their businesses as corporations, because it meant a lower tax burden. But since Trudeau came into power, he removed that benefit in order to make things more fair. But he didn’t bring the doctor fees back up. And now we have no more doctors!

I’m not an accountant but the point remains: We have a history of inventing taxes and fees that are based on economic foundation, but implemented in a way to increase taxes. So let’s start by decreasing income taxes and regulation before we have any conversation about raising property taxes.

How are property taxes related to city services?

Andrey: To revisit what Tom said about property taxes, I agree that Vancouver is a great place. But how much of that is due to city services? The first time my bike got stolen from my garage, I got a phone call from the police. The second time, I didn’t even get a phone call. I had to fill out an online form. So as far as I’m concerned, the city spent $0 to protect my bike.

Our city services are nowhere near what they should be. My garbage didn’t get picked up for a month last Christmas! I am hopeful things are turning around with the new administration, but that wasn’t the case last year.

How are other cities in Canada making ends meet, providing the same services or better, with lower property taxes?

“font-weight: 400;”>The fact that Vancouver homes are more expensive doesn’t make city services more expensive. It costs the same to collect your garbage whether your home is worth $100,000 or $100 million.

The fact that property taxes are linked to property values already makes them progressive so that people with high property values are subsidizing everyone else.

Tom: Let’s say you live in Toronto, make a lot of money as a lawyer and have a vacation home in Vancouver. Should you get to use your Ontario income to write off your BC property? Or should the write-off only be for a primary residence? In my opinion, it should only be for your primary residence. We don’t have a second homelessness problem. But it’s a valid political question.

Another question is around raising dollars by income or by property. You can get there by cutting income taxes, raising property taxes or doing both. Anytime you make a proposal, you should get there with a balanced budget.

We’re a rich city and our public schools are not what they should be! There are people sleeping on the street in the cold! Of course, these are hard problems to solve. Should we spend less money? Should we spend more? It’s a real trade-off.

Keep your finger on the pulse of Vancouver’s real estate market with our Live Wire email newsletter.

Are higher taxes how we solve Vancouver’s problems?

Andrey: Tom is correct; our public schools should be a lot better. There are people in BC who need help. Where we disagree is how to get there. To me, it’s our high-tax and high-regulatory system that is causing this. We’re chasing away businesses.

I want to help. And the way to do that better is by reducing our income taxes and regulation so people choose to do things in BC. The resulting economic boom will provide enough revenue for better schools and to fight homelessness.

Land is not moveable but the value of land is moveable. It’s determined by the people. If we start to raise property taxes without changing our other tax systems, we won’t get those people in.

How do we create more housing supply in Vancouver? And how do we allocate our current supply?

Tom: There’s a fixed number of seats in BC. We allocate the seats by saying if you don’t pay the price, you’re out. That scares people away. Should it be the 25 year old trust fund baby or the 25 year old engineer who wants to work who gets to live here?

Ideally, we want more people to get to live here. One way to do that might be a more efficient tax system. Letting more people live in homes in Vancouver would also do it. 70-80% of the land in Greater Vancouver is single family only, which is limiting.

Andrey: The fixed number of seats is a choice due to paperwork, regulation and red tape. We’re limiting the seats on purpose.

Vancouver is a nice place to live. But since there’s a limited number of seats, the price goes up. The solution is to increase the number of seats, not to let the government allocate who gets a seat.

High rents and high prices in Vancouver are not due to foreigners or trust fund babies – the real cause is our policies that artificially limit supply.

Tom: A lot of people looked at what Ticketmaster did with Taylor Swift tickets and said it was terrible what they were doing. Only people who are willing to pay the most get to see her. That’s how things are going in Vancouver. There aren’t enough seats to see Taylor Swift – there aren’t enough homes in Vancouver.

I don’t think REITs are particularly active in Greater Vancouver. I wish they were! I wish there were more apartments owned by REITs in Vancouver – the key is more apartments. Chasing away allocation by the private sector isn’t the solution.

We’ve been hearing a lot about REITs in the media lately. Is the government’s response to REITs and rental supply working?

Andrey: I’m not saying we should have zero government, but our government is too big and too involved in every aspect of our lives.

The recent announcement of a $500 million fund to buy existing rental properties is not the right answer. David Eby referenced REITs being the culprit; they’re buying all these apartment buildings and kicking out the tenants to redevelop them. So the government is going to use the $500 million fund to buy the buildings before the REITs can.

That sounds good politically, but it’s a prime example of how taxpayer funds are used to hurt us, particularly hurt renters.

They’re spending taxpayers’ money to restrict rental supply by disrupting the people who want to build more. We’d be better off putting the $500 million in the ocean.

You may be asking, “What about the tenants who already live in those buildings?” They’re not any better off. We’re allowing them to live in a building that is falling apart but the moment they have to move for whatever reason, they’re stuck in a market with no supply. So even the individuals we’re trying to protect are worse-off because of this policy.

In my opinion, the solution is to remove obstacles to building. Competition will protect tenants. If you have a bad landlord, you will move. That’s how it works in Seattle – they have vacancy, choice, a lot of purpose-built rental, etc. I’m sure there are bad landlords in Seattle, but tenants have the option to move because there’s availability and incentives.

What should the government’s role in housing supply be? How can we get past supply gaps?

Andrey: The reason that projects stop is because it’s so expensive to build in BC, primarily due to high taxation and government regulation. The ROI needed on any development is through the roof! So the moment the market starts to shift, developers can’t make ends meet.

The solution is to cut regulations and reduce taxes on housing development. We want to encourage housing development. That way, developers will be able to build even in soft markets.

We also have the issue of land prices. If a developer paid a huge amount for the land, that might cause their project to stall if the market shifts. The solution is to make sure every piece of land that is sold can be developed on. We have artificial restraints on land use that make land expensive.

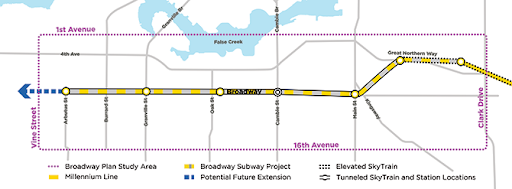

Tom: Impact fees are tricky and can be done better or worse. The “right to return” of tenants with something like the Broadway Plan is interesting. I agree with Andrey that there isn’t enough rental supply, so tenants are holding on with as much strength as they have to their current place.

It would be irrational for tenants who have lived in a rent-controlled building for 15 years to be fine with it being redeveloped. But whether that works out for tenants in the aggregate is an interesting question. The con is they lose their current place but the pro is better overall rental supply. Giving renters another alternative, like opening up land use, is a better solution.

Whether you need to decrease fees or not I’m not so sure. I don’t think the province wants every property redeveloped all at once. You need to set fees so you get as much redevelopment as you want. If the fees are too high and no one is applying, lower them.

But if the fees are so low that developers are tripping over themselves to get in, you can raise them. That would also cause a back-up at city hall and a labour shortage to get all the work done.

So pricing could be too high but I think the bigger culprit is the unavailability of development sites.

Since 2016, Vancouver has brought in a lot of taxes and measures to try and restrict demand. Are we better off today than we were before those measures were introduced?

Andrey: Neither are good – then or where are now. I think it is worse right now. The vacancy rate has remained at 1% for rentals in Vancouver. We’re not better, we’re not worse, we’re the same. We haven’t solved our problem.

The issue is that our solutions have always been more regulation, more government intervention and more taxes. That has made it more costly to build.

And Tom is right, there is an optimal fee for development. But where we are today is too high; we’re not getting enough development. And even if you say today is a soft market, we weren’t getting enough development in 2018 or 2019 when it wasn’t a soft market.

Vancouver is averaging 1,200 rental units a year while Seattle is building 18,000 units per year.

Tom: One thing I will point out is we build a lot of condos while the US builds a lot of purpose-built rental. If you look at both condos and purpose-built rentals together and divide it by population, maybe Vancouver did keep up with Seattle. I don’t know.

I’d be weary of overselling how great it is for renters in Seattle. I think it was for a moment. We saw the same thing in New York during covid and now rental prices are back up.

Vancouver is a fantastic place that people want to live. The private sector can only do so much. Every policy on the table should ask can we make things better? But I don’t think we can make things better, we can only make things less worse. I don’t think we can judge policies based on if things are more expensive today than they were five years ago.

Are market rentals and condos considered equally within the limited number of seats in Vancouver?

Tom: There are benefits to having condos, such as the security of owning and the flexibility to own and rent. Purpose-built rental is great too because they can be managed professionally. What we need is more housing units, both condos and purpose-built rentals.

The city has gotten way too hung up on putting their thumb on the scale of purpose-built rental. Like Andrey said, they’re paying a lot of money on something that isn’t just getting the units built.

If we want to help renters who are struggling, give them money. Don’t meddle with what the developers are doing. Spend the money on helping people out with tax cuts or entitlements.

Andrey: I love it! I absolutely agree.

Helping people by meddling with the market doesn’t help people at all. Most times, it just ends up hurting the very people you’re trying to help.

Give them cash. Don’t tie your help to a particular situation, like a certain job or place to live, because as soon as that person’s situation changes, the money is gone. We want people to better their situations – to get a better job or find a better place to live. We shouldn’t lock them into a particular situation and make upward movement harder. Give them cash and leave the decision with them.

In the meantime, we need sufficient housing. We need competition among landlords. I’ve rented from both professional REIT owners and small landlords. Neither were great because the landlords know I have nowhere else to go.

And the landlords have no incentive to do anything, since they know they won’t lose tenants. Plus they can’t afford to do anything because it will take years to get permits, property taxes have gone up, labour costs have gone, and rents have not. Even if a landlord wanted to improve a building because it’s the right thing to do, they can’t afford it.

We’re telling landlords they can’t do anything. We’re telling tenants to stay put. But we want to encourage a dynamic society! We need competition so people can move out and move up to better situations.

There’s always another bad guy to blame for Vancouver’s real estate crisis. Will we ever move past this?

Andrey: I’ve discovered that my kids are incredibly creative in finding someone to blame for the mess they’ve made. I think our politicians are the same way. They have always created culprits for our housing troubles that they can point fingers at. They point the finger at everyone except for themselves and their policies.

If we don’t remove the red tape and increase supply, we’ll need to keep finding culprits. But we’re running out of culprits – we’re actually recycling them!

But the real reason we have a housing crisis in Vancouver is because we’re restricting supply and we’re taxing housing like we want to discourage it.

We’ve created a nightmare market. And our response is more red tape, more regulation and more taxes.

Tom: There will always be a villain. We will always find someone to blame for our problems. I’m worried that our next villain will be immigration. Immigration is a great thing– I’m an immigrant, Andrey is an immigrant, we’re all children of immigrants.

But if we have finite real estate and a growing population, rents and prices will go up. People won’t be able to live where they want to live and I don’t see how they won’t be irritated with immigration. I think it’s unfortunate and I don’t think people should have that attitude, but I think it’s unavoidable.

If you need another reason for why we should fix housing in Vancouver, decreasing the vilification of immigration is a strong one.

Andrey: That’s another thing Tom and I agree on. Immigration is an engine of growth. Our issue is we’re trying to stagnate our society when we prevent people from moving or building homes. Then anyone who comes in becomes a villain.

So if we removed the constraints around supply, there would be enough housing. People tell me we can’t hold everyone from China or everyone from Bulgaria, where I’m from. Sure we can! Canada has the second most land of any country in the world. Our housing troubles are of our own making.

There’s no reason why Canadians can’t afford homes in Canada. And there’s no reason why immigrants can’t afford homes in Canada either.

Tom: I largely agree. I think some fees are healthy for raising revenue. Another point I’d make is that yes, there is tons of room in Canada, but immigrants don’t want to move to that part of Canada. There are natural and private sector limits we run into.

We don’t hear about a lot of pre-construction in Vancouver anymore. Are other municipalities in BC doing better than us?

Andrey: The new Mayor of Vancouver, Ken Sim, promised a 3-3-3-1 Permit Process referring to three days approve home renovations, three weeks to approve single family homes and townhomes, three months to approve professionally designed multi-family and mid-rise projects where zoning is already in place, and then one year to approve a high-rise or large-scale project. Let’s hope that actually happens!

Not having enough staff or money to support this plan isn’t a good argument. The city can charge more. Let’s hold our new mayor to this promise. That’s the first step in getting more supply.

Tom: Part of the problem is the fees – they’re too low and things take too long. You hear of people paying $150 and then waiting for four months. I’d rather pay $1000 and get it done faster.

Andrey: I have no problem with a fee for a service. You’re paying to get something done. The fees and taxes I object to are the ones that are collected and put into a general pot where, best case scenario, they’re wasted and worst case scenario, they make people worse off.

What is the headline for real estate in 2023?

Andrey: I think the headline for 2023 is going to be about interest rates, not taxes and regulation. Interest rates have moved the fastest they ever have. The problem is it takes 6-9 months for an interest rate increase to filter through the economy. We’re only just starting to see the effects of the initial raise; we have no idea what the subsequent raises will do.

The initial jump was needed to curb inflation but I think we’ve gone too far. I hope we’re able to bring interest rates down before we enter a severe recession. I think the Bank of Canada has gone too far and they’ve realized it.

Though to be fair, they have to keep up with the US or else it’s an automatic increase in inflation. So we can’t fall too far behind the US. But I’m hopeful the US Fed will start to hold soon.

Tom: I agree with Andrey; interest rates are really important. We have seen prices come down but people cannot afford homes at these prices, given these rates. If the rates persist, prices have to come down. But a lot of people think the interest rates won’t persist, so we’re at a bit of a stalemate. But how many months will the stalemate last? It can’t last forever.

Maybe the central banks start lowering interest rates sooner rather than later, but I don’t fault them for what they’ve done. I don’t fault governments for spending too much money during covid to keep people employed and able to pay their rent, even if it increased inflation. But at the same time, the central banks can’t be wimpy about inflation.

Once the weight comes off the interest rates, we’ll get our usual explosive Vancouver real estate market.

Keep your finger on the pulse of Vancouver’s real estate market with our Live Wire email newsletter.

Episode Host

Adam Scalena

Adam is a full-service realtor, specializing in Vancouver’s best areas. His systematic approach to real estate and dedication to his clients has consistently placed him within the top 10% of realtors operating within Greater Vancouver.

Matt Scalena

Matt is real estate obsessed and considers himself a lifelong student of the Vancouver real estate market. As a co-manager of the Scalena Real Estate team, Matt prides himself on expertly advising buyers and sellers on all aspects of the fast-paced, dynamic Vancouver real estate market. He is present at every stage of the process, from that first phone call or email right through to when keys are exchanged between sellers and buyers.