Episode 365 – March 30, 2023

Listen On: Apple Podcasts | Spotify | Google Podcasts | YouTube

What does the smart money think about Vancouver real estate in 2023? Vice President, Research Services & Strategy at GWL Realty Advisors Wendy Waters sits down with Adam & Matt to explain exactly that question, delving deep into the most up-to-date data on the Metro Vancouver real estate market & highlighting the most important trends. And these trends will definitely surprise!

What data points are the institutional players focussed on? What do these trends mean for the market (& region) in the next 1,2 & 5 years. And, maybe most importantly, is the smart money currently buying Vancouver? Tune in to find out!

Guest Information

Wendy Waters

Wendy Waters is the Vice President of Research Services & Strategy at GWL Realty Advisors. Wendy Waters has 20 years of experience in real estate research, nearly 16 of them with GWL Realty Advisors. At GWLRA she leads Research Services & Strategy team, which provides strategic analysis to support and grow the portfolios of real estate under management including office, industrial, retail and multi-residential assets. The research team focuses on the economic, demographic and social drivers of real estate performance as well as capital flow and market trends that shape returns.

A key responsibility is providing proprietary research and analysis to support the development of new rental buildings (GWLRA has over 6000 units in the development pipeline including several in the Vancouver area) as well as the asset strategies for 12,000 units of multi-residential under management across Canada. Wendy regularly publishes research at gwlra.com/research and shares insights on panels across Canada. She is active with the Urban Land Institute (ULI).

Episode Summary

Wendy Waters takes us on a data-driven journey through the Vancouver rental market crisis and emerging Vancouver real estate trends. How do we fix supply? Does it make sense to build in the city? And has Vancouver reached its breaking point?

All about Adam’s reno project and how to find a deal when supply is low?

I have a Private Client Services (PCS) account set up to find the specific type of property that will work for me. I get alerts anytime a property meets my specific criteria. When I get that alert, I check it right away. 99% of them I don’t have to explore further, but it only takes two minutes to check.

If there are no photos on a listing, I always explore it further. It’s a sign that there’s an opportunity because most people will ignore a listing without photos. They assume it’s a dog or they don’t have the ability to dig deeper.

After digging a bit deeper, I then ran the numbers on a spreadsheet that Melissa on our team built out. You just plug in the numbers to see if the numbers pencil. If they don’t, you move on.

If the deal looks attractive, you then have to find your way in and you have to be first. This deal came out on a Monday and they were doing first showings Tuesday and Wednesday. But I had an opportunity to see it on Monday. I drove out, viewed the property, called my wife and then raced home to make an offer. By 10:30 pm that night, I got it done.

It was a multiple offer situation but we were able to secure it with a cash-only, subject-free and quick-close offer. One of the other offers was actually higher but mine won out because it was subject-free. I was doing my due diligence at the same time.

We now have the rescission period in BC that gives buyers more confidence to go in subject-free.

Anytime you can add substantial value, such as with forced appreciation that is within your own control and not reliant on the market, it’s a good idea. With this townhouse project, I’ll be able to add that value by adding a bedroom and a bathroom. That changes the offering for the end-user. It’s very much a missing middle project.

Right now, the place is uninhabitable. I want to make it perfect for a family and at a price point that isn’t unreachable for most.

Follow along on Instagram to see how the renovation project goes!

Keep your finger on the pulse of Vancouver’s real estate market with our Live Wire email newsletter.

Who is Wendy Waters?

I’m the Vice President of Research Services and Strategy at GWL Realty Advisors. We manage the real estate assets of pension funds and institutional real estate. I’ve been there for 17 years but have been doing real estate research for over 20 years.

I actually have a PhD in economic history but transitioned into the dot-com sector in 2000. Once that imploded in 2001, I answered an ad in a newspaper looking for someone to bring a research lens to the real estate sector, which hadn’t really been done before.

I got excited about the questions around how cities work. I did my doctoral research in Mexico City and got very interested in cities from there. That played into my interest and research in real estate. It’s all about the urban fabric and how it fits together.

What did it look like to apply an academic lens to real estate data?

The first piece I wrote in 2003 that got some attention was around what the potential 2010 Olympics coming to Vancouver would mean for real estate. I looked at how past Olympic games had affected other cities comparable to Vancouver. How much more office space is needed? What happens to the economy? Is there an Olympic hangover?

I actually took a look back at that piece in a February 2020 report and it was fairly accurate. We did have the economic crisis in 2009 that we didn’t foresee in 2003, but we did see the shifts we expected in temporary office needs and employment. I was pleasantly surprised.

What other cities resemble Vancouver and our market?

For the Olympics, I had to go with cities that had hosted the games recently. Sydney was one with similar geographic constraints to Vancouver and was also an international city.

But generally, Vancouver is a unique city and it can be hard to find a comparable city. The vacancy rate is so tight here. There are land constraints and some policy constraints.

We do look up and down the west coast for similarities and we compare Vancouver to Toronto a lot. But it’s hard to find a perfect comparison; we have to take pieces of cities from around the world.

Is every city unique or is Vancouver a special case?

In Canada, every city is very unique. In the US market, it seems like they have some cities that work in similar ways. For example, port cities or natural resource cities have their similarities. We look at every city and look at what drives its economy.

What kind of work does GWL Realty Advisors do?

At GWL Realty Advisors, we manage institutional real estate. We have open ended funds and do direct investment for some of our clients. We have both assets under management and new development.

Pension funds use real estate to pay their unit holders. They need cash flow to pay out their retirees. Most pension funds have 10-15% of their assets in real estate. They like to have that steady income flow that real estate can provide. We work with union, private and government pension funds.

What do you do in your role in research at GWL Realty Advisors?

With the research team, we look at what the right strategies are for these pension funds.

It’s not just about finding the right strategy for today; it’s about what the right mix of assets should be over the next 5-25 years to ensure a steady flow of income and decrease volatility while diversifying across geography and asset types.

My team looks at what happened in the past and creates models for the future to come up with our recommendations. For example, multi-family residential rental is a fairly low return asset but it also has low volatility. You can always find a tenant but you probably won’t get rich. With office and industrial, you might get higher returns but there’s more risk in a soft market that you won’t find a tenant.

In a market like Vancouver, there’s less risk of vacancy. But that’s why it’s expensive, because the demand is more reliable. So part of our job is balancing that.

Keep your finger on the pulse of Vancouver’s real estate market with our Live Wire email newsletter.

What type of assets are attractive over the next 5-10 years?

Rental housinghas been a focus of ours for a long time. That’s still a very attractive asset. There’s a severe housing shortage in Vancouver and Toronto, so that means strong demand. Managing costs and rent control are the challenges, however.

We still likeoffice real estate in the long term but there’s been a shift. We have to consider which office buildings and where they’re located. But we do believe people will be working from office buildings more than not. You have to balance the challenges and opportunities in office real estate.

Industrial real estatehas been on fire for the last 5+ years in the MTV (Montreal, Toronto, Vancouver) markets and across North America. We like it for the long term.

We really like grocery-anchored retail. It’s performed very well through the pandemic. We’re looking at those retail centres in more suburban or growing markets. It’s a place people have to go to every day.

How is the rental market in the Lower Mainland?

I think CMHC said that rental vacancy in the Lower Mainland was at 0.9% and 0.6% for the downtown peninsula. They do their survey every year in October. We also have housing models that we use to give numbers to our development team.

Our 2022 models show that we were 33,000 units short on purpose-built rental in Vancouver. In the last year, it’s only gotten worse since we added 3,800 net units and 78,000 people to the region.

If you include ownership and rental, we have about 18,000-20,000 net completions for 64,000 adults. So we’re underbuilding by more than half. We’re not adding the housing that’s needed.

Has lack of rental supply been a problem for a while?

If you look at rental housing in 1990, there were 110,000 purpose-built rental units in Metro Vancouver. By 2023, it’s 118,000 units. We’ve managed to add just 8,000 net units in 30 years. And half of that was in the last year! So we’re doing better but it doesn’t make up for decades of not building rental units.

Newer product is nicer and usually more expensive. Traditionally you would live in older, more run-down product when you were younger and had less money, and then transition into newer product as you aged and earned more.

But because that older product isn’t available – we didn’t build it – we’re seeing more people living with their parents and in overcrowded households.

Every year we look at how many 20-34 year olds we add to the market, who are the prime rental demographic, compared to how many purpose-built rentals we add. It’s a stark difference.

Why have we done such a bad job of providing purpose-built rental in Vancouver?>

For a long time we were focused solely on condo product. Condos are easier to build from a capital perspective. Condo developers can pay more for a site, can reduce risk through pre-sales, etc. There’s more risk and capital needed for rental projects.

Obviously some of those condo units show up on the rental market, which is good because we need the supply. But it’s not a reliable rental stock. Investor-owners often learn that being a landlordisn’t as passive as they thought, resulting in a lot of turnover to owner-occupiers.

End-users need a home now; they want to move into a condo that is already finished. There’s a value for them in moving into a home and they don’t need that same return that an investor would require.

There are also challenges for renters who are relying on a landlord who might live far away versus a property management company that can solve problems right away.

What’s preventing us from building more purpose-built rental right now?

The challenge is figuring out how you make the numbers work. For pension funds, there are rules we have to follow. We can’t landbank. So the length of the approval process is a challenge for us.

Another big challenge is the risk. If a project has to be rezoned or go to a public hearing, you may get a no. We don’t build condos, so we can’t use that as a back-up plan if the rental project doesn’t go through.

In Ontario, there’s an appeal process if your proposal gets turned down. But that adds a year to your timeline. And time is money; there’s an opportunity cost. That’s why a lot of people are building rental projects in other areas where approval processes are faster and where there is less rent control.

Has the Residential Tenancy Act created a burden for people trying to come into the rental market?

Not so much the act itself but some of the changes the Residential Tenancy Branch has made. Up until 2017, rent control was CPI+2 in BC; Ontario was just CPI and California was CPI+7. A lot of the projects that opened in the last year started under CPI+2, which is why we saw more projects because CPI+2 was attractive for Canadian capital.

But now the allowable rental increase has changed, making the numbers difficult to pencil out.

Keep your finger on the pulse of Vancouver’s real estate market with our Live Wire email newsletter.

It feels like it doesn’t make sense to build anything in Vancouver right now.

That is the challenge in our market! It’s difficult to build purpose-built rental and it’s difficult to build condos, but people keep coming to Vancouver. What can we do to keep construction going? I am very worried about our current situation.

We hope interest rates come down. With institutions that have a 25 year view, they can manage the extra cost of interest rates right now. But that’s harder for private companies to do. I’m worried about the housing supply pulling back.

Where do Vancouver rents go from here?

Rent in Vancouver is going up! People keep coming to Vancouver and they’re coming for good jobs. Immigrant incomes are up 64% over the last nine years. One year after becoming a permanent resident, their income is up 64%.

That’s substantial, especially if you’re looking at a dual-income household. You can rent new product in a high-income area of Vancouver with that kind of income.

Let’s talk aboutimmigration trends and population growth over the next few years

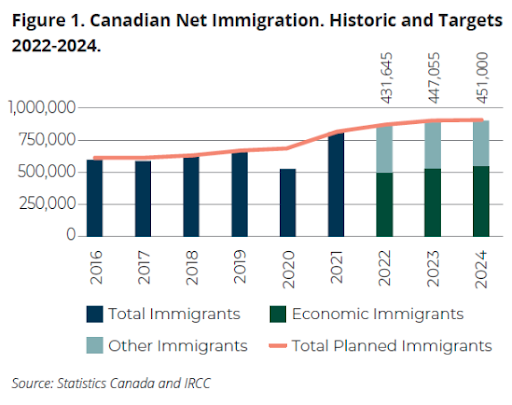

The 1.5 million to Canada in the next three years refers to the number of new permanent residents. But there are also a large number of non-permanent residents welcomed to Canada each year. Q4 of 2022 saw about 200,000 of them.

In 2022, it’s estimated that a million new people showed up to Canada which includes students, temporary employees, Ukrainian refugees, etc. And all of those people need a place to live. You can’t model future housing needs on just permanent residents since all of these people need a place to live.

During the pandemic, 80% of new Canadian permanent residents came from the pool of non-permanent residents who were already here. That’s because the borders were closed. But usually it’s 20-30% of new permanent residents who are already here.

Historically 18% of new Canadians settle in the Lower Mainland, but that number varies a lot year to year.

Is there a breaking point at which doing business in Vancouver just doesn’t make sense?

I don’t know if there’s an actual breaking point but there is a bending point where Vancouver becomes less attractive. And I think we’re very close to it now.

I am worried that not enough housing means there’ll be a pullback in office-oriented jobs in Vancouver. If those big tech companies hear their employees can’t find housing in Vancouver – even making a six figure income – they will have to find another city to base in. Calgary is a great candidate and I wouldn’t be surprised if some go there in addition to, or at the expense of, Vancouver.

Some of the suburban municipalities around Vancouver have done a great job at adding more housing and intensifying retail sites. They’ve been focusing on high density housing, mixed-use communities and walkable communities. But places like Vancouver that are already established need to do more of that.

Even if we find a way to turn on density in Vancouver, it still takes 2-3 years to deliver a building. And that’s assuming you have all of your permits and can find the trades and construction to get it done.

We’ve been hearing a lot about the trades issue.

Across the country, the real estate industry has been pushing the government to bring in more people who can contribute to trades and construction. In the past, we’ve welcomed people to come work in some of the lower skilled jobs in the healthcare system as a path to citizenship. We need to do the same for trades and construction.

What’s the worst case scenario for Vancouver’s bending point?

Will the bending point cause a crash in single family housing? I’m not sure. We saw a softening in the suburban markets, mostly in pockets where it got overheated. If you have a single family lot in Vancouver, you probably paid a lot less than what it’s now worth.

I think there would be an easing of the high-end real estate market at the bending point. We’ve seen those projects not get their pre-sales and have to pivot to a different audience. The luxury market has fallen off in Vancouver.

Any real estate is still going to do okay in Vancouver. Right now it’s about what you can carry with high interest rates. But even if you have to sell, there will be buyers because of all the people coming in.

What and where would you tell someone to invest in with a $2 million budget?

This is a bit outside my area of expertise. But I would probably look at something in East Vancouver near the new Broadway line or in North Vancouver along the Lonsdale corridor. A redevelopment site with rental potential might be a good play.

What does the future of Vancouver look like?

Hopefully we have a city council that is going to add a lot more housing to Vancouver and revitalize neighbourhoods that have been fading. There’s a huge opportunity in areas like Kitsilano and parts of East Vancouver that are very walkable. I think the next 10-15 years offer huge opportunities for this region.

But we need to fix the housing supply and that means housing everywhere. It can’t just be Brentwood and Burquitlam. We absolutely have to say yes to more housing. I know it’s hard for people who have been in single-family homes forever but we need to do it.

The older neighbourhoods of Vancouver need to embrace change. By bringing in a diversity of housing you bring in a diversity of people.

People are coming to Vancouver. If the people who work at your local coffee shop can’t afford to live near it, that coffee shop is closing down. If you don’t want to lose that quality of life, you need to embrace some housing and economic diversity. If we can do that, I’m excited for the next 10-15 years.

Keep your finger on the pulse of Vancouver’s real estate market with our Live Wire email newsletter.

The 5 Wire: Getting to Know Vice President, Research Services & Strategy at GWL Realty Advisors, Wendy Waters

What is one book you recommend?

Weapons of Math Destruction by Cathy O’Neil. It looks at the limits of data and how partial data can become the whole story. Instead, we need to look at things more holistically.

What new belief, behaviour or habit has most improved your life in the last couple of years?

Yoga. I took it up in March 2020 when we were stuck at home. I’ve always been told to try meditation and to stretch more. Yoga combines the two; it gives me a mental cleanse while letting me move. I do it from home with an app every morning on our back deck.

What have you been binge watching lately?

Star Trek: Picard

Favourite band or music?

That’s tough. I haven’t been listening to a lot of music lately but I’m seeing Billy Joel and Stevie Nicks in LA next week, so I’ll go with that.

H4: What is something you’ve purchased recently for under $1500 that has had a positive impact on your life?

I’ll go with the Apple watch. I like that the alarm just buzzes on my wrist so I’m not waking up my husband.

Keep your finger on the pulse of Vancouver’s real estate market with our Live Wire email newsletter.

Episode Host

Adam Scalena

Adam is a full-service realtor, specializing in Vancouver’s best areas. His systematic approach to real estate and dedication to his clients has consistently placed him within the top 10% of realtors operating within Greater Vancouver.

Matt Scalena

Matt is real estate obsessed and considers himself a lifelong student of the Vancouver real estate market. As a co-manager of the Scalena Real Estate team, Matt prides himself on expertly advising buyers and sellers on all aspects of the fast-paced, dynamic Vancouver real estate market. He is present at every stage of the process, from that first phone call or email right through to when keys are exchanged between sellers and buyers.